The failure of crypto exchange FTX and sister hedge fund Alameda is too sprawling in its financial, political, and cultural reach, and too messy in its origins and implications, to distill in one article. But here’s some background and a list of good analyses.

First, the basics: In 2017, 26-year old MIT graduate Sam Bankman-Fried (SBF) launched Alameda, a hedge fund specializing in crypto. In 2019, he launched FTX, a platform to store and trade crypto assets – coins, tokens, and currencies. Customers deposited money in FTX, as they would an online stock broker. FTX lent customer funds to Alameda, which Alameda deployed into risky trades and investments. As “collateral,” Alameda gave FTT tokens and Serum tokens to FTX. FTT and Serum tokens were the creation of…FTX and Alameda. These tokens were thinly traded and, as far as I can tell, functioned like (worthless, it turns out) IOUs.

To understand FTX’s “balance sheet,” you must read Matt Levine’s darkly hilarious review. The FTX balance sheet was full of bad numbers, confusing numbers, and jaw-dropping non-numbers. For example, one cell was labeled “HIDDEN POORLY LABELED INTERNAL ACCOUNT.” Another asset worth $7 million was labeled “TRUMPLOSE.”

Here was a CoinDesk article from November 2, which began to expose the balance sheet irregularities.

And here was Mark Cohodes alleging a “scam” on October 11 on Hedgeye.

It turns out an incredulous Matt Levine was already on the case six months ago, when SBF described his business model of crypto “yield farming”:

As the private valuation of FTX soared to $32 billion – including recent investments from vaunted investors like Sequoia Capital and TPG, and pension funds like Ontario Teachers – SBF spent money like a Bahamian pirate: renaming the Miami Heat basketball arena, enlisting a crew of swanky celebrities, and buying 9% of financial app Robin Hood, just for starters. Although the company was founded in July 2019, SBF gave $10 million to Joe Biden’s 2020 presidential campaign and another $40 million to Democrats in 2022, second only to George Soros. He said he wanted to give $1 billion to politics in 2024.

Safe and Effective Altruism

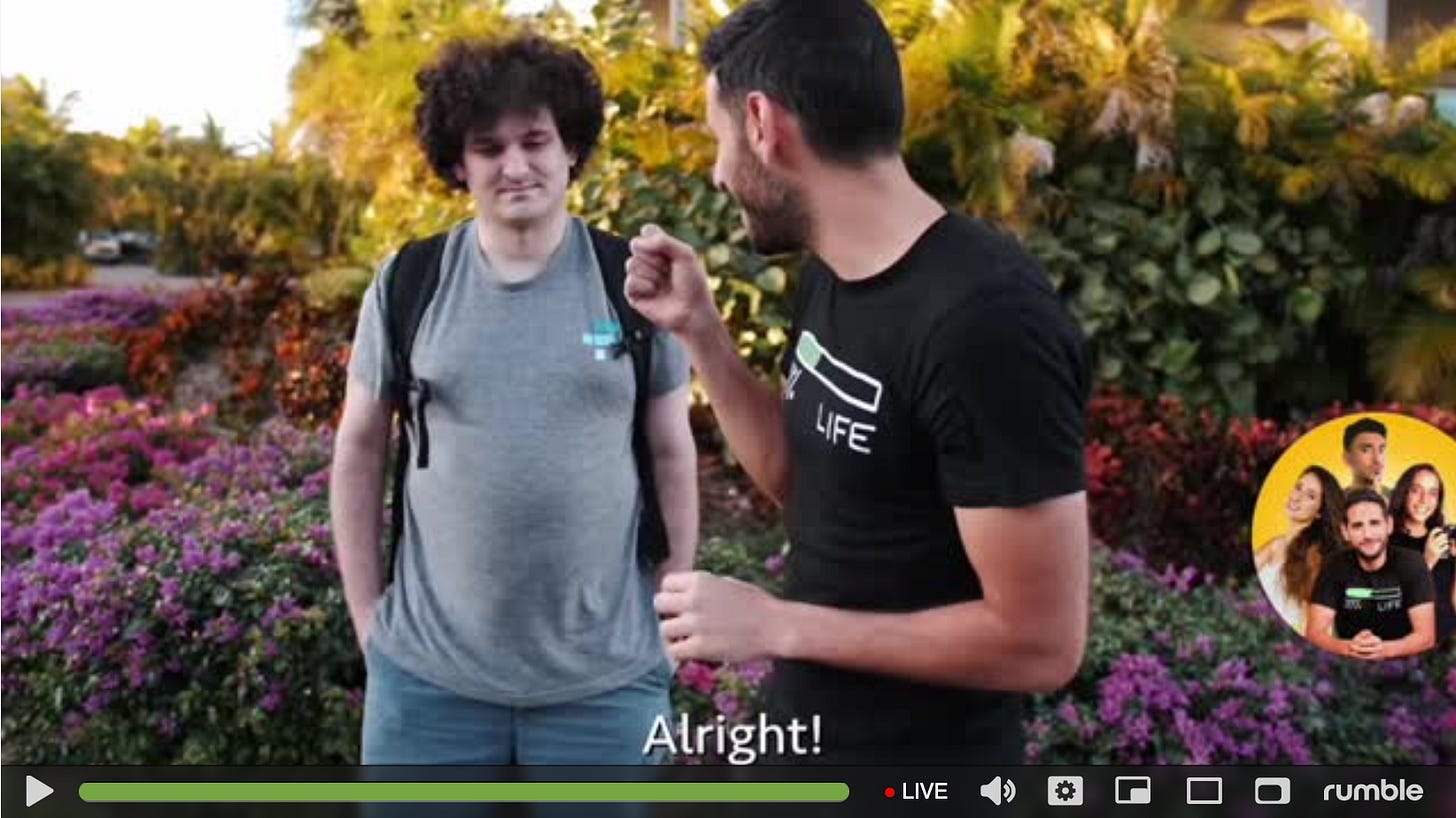

SBF built his image on a philosophy known as Effective Altruism, the supposedly new idea that philanthropy can be improved through better measurement. SBF promoted every fashionable cause: climate, pandemic preparedness, animal rights, etc. Some also call the philosophy Earn to Give – make as much money as possible so you can give it away. The following video sums up the marketing strategy which garnered, for example, the gushing cover story in Fortune as recently as August, wondering if SBF was the “next Warren Buffett.”

As you can see, Effective Altruism as practiced by SBF looks more like brazen sanctimony, or BS. Bret Weinstein and Alexandros Marinos independently arrived at a perfect moniker – “Safe and Effective Altruism.”

Samo Burja of Bismarck Analysis skewers the many woke conceits of Effective Altruism.

Tyler Cowen exposes an additional conceit: if Effective Altruists are better at spotting and preventing “existential risks,” as they claim, why didn’t they anticipate the collapse of their own company?

We should interject that there are many sincere and, well, effective Effective Altruists. Although they may overestimate their data-driven-do-gooder abilities, many of them do good things to help the world.

Expert Commentary, Embarrassing Cleanup

Here’s the self-described “definitive thread” on the saga, taking you behind the scenes, by quasi-insider Jason Choi.

Here are two threads by Jesse Powell of FTX-competitor Kraken.

Arnold Kling compares the U.S. Fed and Treasury to FTX and Alameda. In a separate post, Kling then suggests the public is eager to be fooled by would-be messiahs, as in The Music Man.

Here was Sequoia Capital’s since-deleted article lavishing praise on SBF when they invested $240 million.

And here is the ridiculous New York Times clean up job, which failed to mention most of the crucial details of the fraud and all of the deep political links.

Here are more details of the attempted rescue of FTX in a November 16 Reuters story.

And if you already know all this stuff and are really hungry for new angles on the story, see “FTX as a Controlled Demolition.” As Balaji Srinivasan says, “They don’t want to jail SBF. They do want to seize your BTC.”

Closing Thoughts, For Now

By blending the most potent virtual signals of the moment with a high flying techno-trend, SBF created an irresistible mix of woke crypto, or token tokens.

What does SBF’s do-gooder scam say about the last decade of woke capital? From BlackRock’s ESG to the World Economic Forum’s Great Reset?

FTX’s misdeeds didn’t have much to do with crypto-proper, beyond the hype. Thousands of smart people are building real products and companies in the broad crypto world. We hope the FTX scam throttles back the hype without killing the long-term promise.

Here are two additional important articles I read after my post. The first is a crazy DM interview by a Vox reporter, who had previously written a story on SBF and who is an enthusiastic participant in the Effective Altruist movement. https://www.vox.com/future-perfect/23462333/sam-bankman-fried-ftx-cryptocurrency-effective-altruism-crypto-bahamas-philanthropy

The second is an anonymous analysis which speculates that FTX's losses are really closer to $15.5 billion, rather than merely $8 billion. https://milkyeggs.com/?p=175